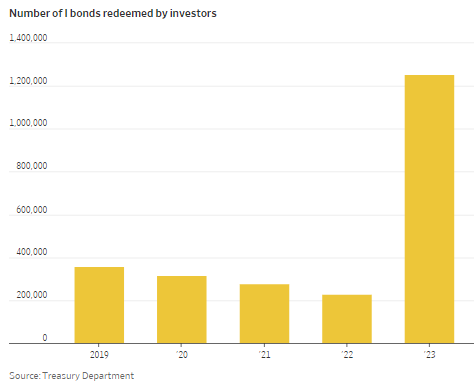

I bonds were one of the hottest investments in 2022. While you are limited to buying $10,000 per individual per year, millions purchased them in 2022 when they had a guaranteed 9.62% interest rate. When interest rates dropped in 2023, according to the Wall Street Journal, $6.45 billion were cashed in—approximately 22 times the total redeemed in 2022. Understanding the tax implications of I bonds is crucial to avoid IRS notices and potential penalties. This article aims to demystify the process of tax reporting for I bonds.

What Are I Bonds?

I bonds are government-issued savings bonds that offer a fixed interest rate combined with a variable inflation rate, adjusted semi-annually. The fixed-rate portion is 1.3%. The variable rate is tied to inflation and got as high as 8.32% in 2022; hence, the 9.62 rate that attracted so many. As inflation came down, so did the rate, and investors cashed them in.

Tax Trap with I Bonds

All interest for I Bonds is taxable for federal tax purposes. The challenge is you are not sent a Form 1099 like you are with other investments. The government’s Treasury Direct site indicates, “A form 1099 will NOT be mailed to you”. You have to log in to the site and find the page to download the form. Most people will easily forget this step because they expect tax documents to arrive in the mail. The end result is that they will eventually receive IRS notices for taxes due plus interest and possibly penalties.

How do I download my 1099 on TreasuryDirect?

If you cannot find the email from the Treasury Department you may have received in January, search for the subject line: “TreasuryDirect 1099 Statement Information.” Finding the form on the TreasuryDirect site is confusing enough that the Treasury Department created an instructional video to demonstrate how to navigate to it step by step: https://treasurydirect.gov/indiv/tools-videos/treasurydirect-1099/.