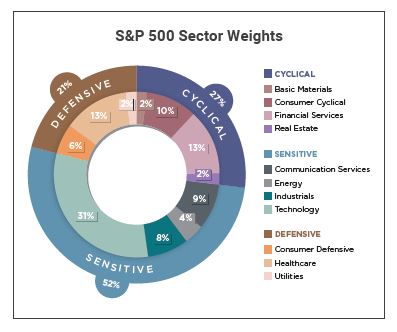

A backdrop to today’s market is the level of stock and sector concentration in the S&P 500 Index (SPX). As of March 15, 24 percent of the S&P 500 is concentrated in five stocks and 33 percent in 10 stocks when combining both share classes of Alphabet. As such, over a third of a roughly 500 stock index is built around ten names. When the highest concentrated stocks are doing well, it bodes well for the S&P 500 and vice versa. The same general theme is present when looking at sector exposure in the S&P 500. Technology and Communications comprise nearly 40 percent of the underlying sector exposure when adding Consumer Cyclicals, concentration increases to 50 percent, while four of the eleven sectors have less than 5 percent exposure. Combining these three sectors is noteworthy as Amazon represents 26 percent of the Consumer Cyclicals, even though a major portion of its revenue comes from Amazon Web Services (Technology), and Meta and Alphabet (Technology) comprise 51 percent of the Communications sector following the transition of these stocks from the Technology Sector to the Communications sector in January 2022.

The outperformance of the largest stocks, often called the “Magnificent Seven” (a term coined to describe the dominant mega-cap performers in the S&P 500), characterized much of 2022. These stocks, composed mainly of tech and communication giants, drove much of the index’s gains, propelling it to new highs despite broader market uncertainties. The lack of market participation by stocks outside these mega names led many market observers to call for a nearing market top, typically a few names leading markets higher while most decline. 2022 also left many market participants on the sidelines following 2021’s steep declines and concern about a slowing economy brought on by lingering inflation and a possibly slow-to-react Fed and the belief that the lack of participation beyond the Magnificent Seven foretold poor market performance.

Fortunately, 2024 is experiencing a broadening of market breadth that began last December. The S&P 500 first broke above its January 2022 record close on January 19. The index has set a total of 17 record highs this year. The Dow Jones Industrial Average and Nasdaq Composite have confirmed, setting new records in 2024. At the sector level, 5 of the 11 S&P 500 sectors have set new records in 2024, and several others are approaching their all-time highs. Additionally, nearly 75 percent of the S&P 500 trades above its 200-day moving average. In contrast, at the March 24, 2000 peak in the S&P 500, 45 percent of stocks were above their 200-day moving averages, and the percentage fell as low as 31 percent in February 2000.*

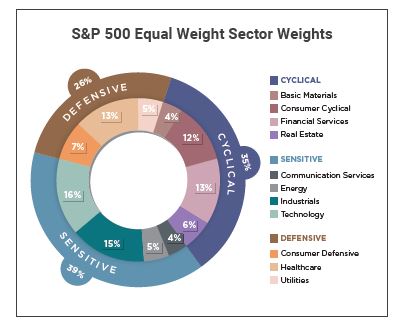

While the mega-caps have been responsible for much of the gains that have pushed the popular averages to new highs, breadth readings have remained strong. Broadening market participation provides opportunities beyond the most concentrated and traditional “household” names. The S&P 500 Equal Weight (SPXEWI) Index (each stock is weighted equally versus by market cap in the S&P 500 Index) has a much different stock and sector exposure than the S&P 500 Index. In the SPXEWI, Technology comprises 16 percent (compared to 31 percent) of the exposure.

High concentration in the S&P 500 offers an opportunity to have a more diverse portfolio than the index itself, at least from a sector standpoint. Even in a 20-stock portfolio, for example, owning a single basic materials stock would garner more exposure to the sector than the S&P 500. The same is true for three other sectors. An example, but it is more to show how easy it is to add some level of diversification versus the benchmark. However, it is still paramount that portfolios remain fixated on areas of relative strength. Diversification does not matter much if a portfolio is diversified in weak stocks. One way to add value is to find ways to overweight a strong but less allocated sector in the S&P 500. Secondly, finding ways to trim back weaker and higher-weighted sectors can help

Most recently, breadth for sectors has generally been stronger for cyclical than defensive sectors. In the most concentrated sectors, mega-cap trends can override breadth trends. Communication Services has been able to shrug off its poor breadth due to mega-cap strength in Meta and Google. Apple’s weakness is a risk for the Technology sector and the S&P 500 more broadly, as Apple comprises just under 6 percent of the weight.

The dynamics of stock and sector concentration within the S&P 500 have significantly influenced market performance, particularly in recent years. The dominance of a few mega-cap stocks dubbed the “Magnificent Seven,” has been a defining feature of market gains, raising concerns about overreliance on a handful of names. However, 2024 has brought a refreshing shift in market breadth, signaling a broadening of participation beyond these concentrated names.

Looking ahead, maintaining vigilance over sector trends and stock allocation remains crucial. While mega-cap stocks have driven recent market gains, monitoring broader market breadth indicators is essential for a more comprehensive understanding of market dynamics and opportunities outside the most widely known names. By staying attuned to these factors and making informed investment decisions, investors can navigate market fluctuations and position their portfolios for long-term success amidst evolving market conditions.

March 18, 2024

* Source: Ned Davis Research

Spectrum Wealth Management, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Additional information about Spectrum’s investment advisory services is found in Form ADV Part 2, which is available upon request. The information presented is for educational and illustrative purposes only and does not constitute tax, legal, or investment advice. Tax and legal counsel should be engaged before taking any action. The opinions expressed and material provided are for general information and should not be considered a solicitation for purchasing or selling any security.